Key Takeaways:

- Private individuals and families are among the biggest owners of gold, holding significant amounts of the precious metal for various reasons.

- Private corporations and organizations also own large amounts of gold, using it as a hedge against economic uncertainties or as part of their investment portfolios.

- Countries with significant gold reserves include official organizations and central banks, which hold gold as part of their national wealth and to support their economies.

- Private gold ownership has an impact on the gold market prices, with buying and selling activities influencing the overall supply and demand dynamics.

- Owning gold can play a crucial role in investment and diversification strategies, providing a safe haven asset and protecting against inflation or currency fluctuations.

- The repatriation of gold reserves has been a growing trend, with countries taking steps to bring their gold back within their borders for security or sovereignty reasons.

- Determining the biggest private gold owners can be challenging due to the lack of transparency and reporting in the gold market.

- The future of gold ownership is influenced by central bank policies and changes in market dynamics, as well as investor sentiment towards the precious metal.

Photo Credits: Ecopolitology.Org by Henry Mitchell

Gold ownership holds both historical significance and importance in modern times. Discover the allure of possessing gold and delve into its historical relevance. Explore the reasons and benefits behind gold ownership and unravel the timeless appeal of this precious metal.

Importance of Gold Ownership

The importance of owning gold is huge. Not just any old metal, it has huge historical and cultural significance. People cherish it for its rarity, durability, and beauty.

Individuals and organizations know of its great value. Wealthy people and families buy gold to protect and diversify their wealth. Companies and organizations buy it to hedge against financial risks and leverage their assets.

Countries with large gold reserves are very important in the global gold market. Central banks and official organizations store it in their national reserves. This affects their wealth and the stability of their economies.

Individuals and investors buying and selling gold impact its supply and demand, and therefore its price. Many consider it a safe-haven asset, making it an investment tool.

In recent years, countries are repatriating gold – bringing it back from foreign locations. This has its challenges, e.g. logistical and trade issues.

Individuals and corporations are the biggest private owners of gold. Prominent investors have tons of it, while companies use it for jewelry production or investments.

Knowing exact data on gold ownership is tricky; lack of transparency and reporting standards make it hard to assess the true supply and demand.

The future of gold ownership will be affected by central bank policies, changing market dynamics, and investor sentiment. Gold’s past is so great, even Cleopatra would’ve swapped her asp for it!

Historical Significance of Gold

Gold has always been a thing of immense historical importance. Its preciousness and desirability can be tracked back to ancient times, when it was used as money, jewellery, and for various religious purposes. Its rarity, durability, and symbol of wealth and power, are the main reasons for its enduring allure.

In cultures such as Egypt, Greece, and Rome, gold was regarded as a sign of divine power and was connected with rulers or gods. It was used to craft exquisite jewellery, beautiful artworks, and grand ceremonial items that showed the richness of those who owned them.

Gold has had an important part in developing the economic systems of multiple regions across the ages. It served as a medium of exchange in early trade systems, and was seen as a reliable store of value. Whenever big gold deposits were found, it often triggered population shifts and altered political dynamics, as empires attempted to control these treasured resources.

In the modern age, gold still has value. Nations began storing large amounts of gold to make their finances more secure and to boost their national wealth. Central banks understood how critical it was to possess gold as a strategic reserve asset that could protect them from economic turbulence.

In addition to its material worth, gold’s historical significance goes beyond this. In many cultures worldwide, it has been tied to lavishness, wealth, and even immortality. From ancient burials that involved gold artifacts to royal courts very often boasting great riches, this metal has always represented affluence and standing.

Investing Tip: Understanding the historical significance of gold can be beneficial when considering its place in investment portfolios or looking at world economic trends. By realizing how this precious metal has impacted civilizations over time, investors are able to make well-thought-out decisions based on past patterns and market dynamics.

Who Owns the Most Gold Privately?

Photo Credits: Ecopolitology.Org by Andrew Allen

When it comes to the ownership of gold, the question arises: who holds the most privately? In this section, we’ll uncover the intriguing world of private gold ownership and explore two main categories: private individuals and families, and private corporations and organizations. A closer look at these sub-sections will shed light on the weighty players in the private gold ownership domain.

Private Individuals and Families

Private individuals and families are a major category of gold owners. They acquire it for wealth preservation, hedging against uncertainty, and to pass on wealth to future generations. Gold has been treasured for centuries as a store of value and symbol of wealth, thus private ownership is of great significance.

The demand from this group can affect gold prices, particularly during economic instability or geopolitical tensions. They can influence market trends by buying/selling huge amounts, causing price fluctuations.

Owning gold offers investment diversification, shielding against currency devaluation, inflation, and other financial risks. It also appeals to investors seeking portfolio stability.

Additionally, individuals and families may repatriate gold due to political instability or to protect their assets. This involves bringing the possession of gold from a foreign land back to their home nation. This trend has been increasing as people seek control over their investments and reduce counterparty risk.

Private individuals and families are a key factor in the gold market, holding gold for multiple reasons. Their actions and preferences can cause price changes, boost diversification, and cause repatriation trends.

Private Corporations and Organizations

Private corps and orgs, including multi-nationals and non-profits, have a major role in gold ownership. They hold huge amounts for investment purposes or for operations. Some use gold to hedge against inflation and currency fluctuations. Others acquire it for manufacturing or jewelry making.

Gold ownership by private corps and orgs has had an impact on history and economics. Certain companies have accumulated large amounts through operations or acquisitions. This has added to the global gold supply and affected market prices.

Private gold owners also contribute to national wealth and the economy. Gold reserves can serve as a valuable asset that bolsters financial stability. Plus, substantial private gold ownership can show confidence in the country’s economic future and draw in foreign investment.

It is hard to tell how much gold private corps and orgs possess. Not all of them report their holdings. This lack of transparency can affect the global gold market, making it hard to gauge supply and demand.

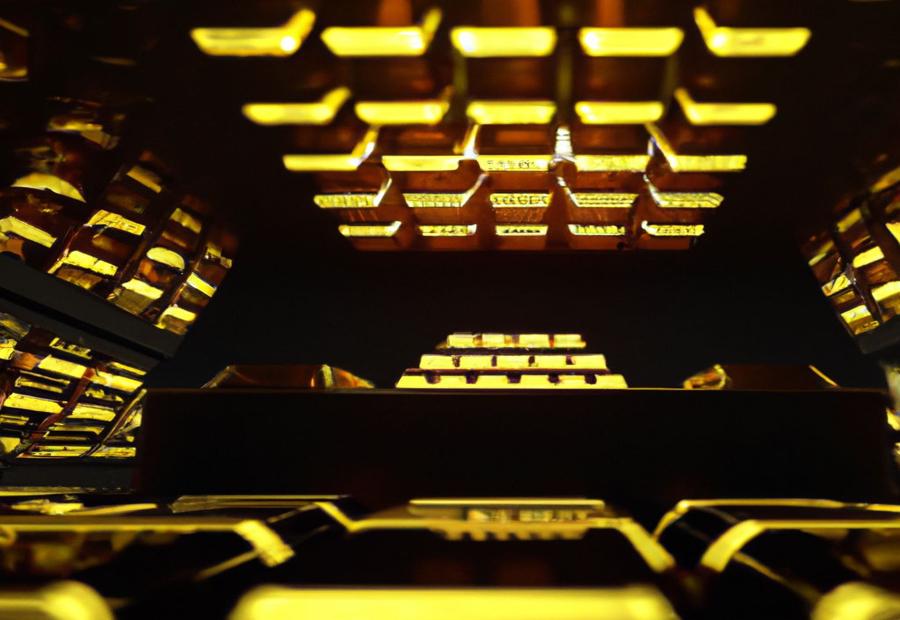

Countries with Significant Gold Reserves

Photo Credits: Ecopolitology.Org by Elijah Smith

Countries with significant gold reserves hold a valuable asset that plays a crucial role in their national wealth and economy. From official organizations and central banks to the impact on economic stability and financial security, this section sheds light on the countries that possess substantial quantities of this precious metal. With compelling facts and figures, we will explore how these gold reserves shape the global financial landscape and contribute to the overall economic power of nations.

Official Organizations and Central Banks

Official organizations and central banks possess considerable gold reserves, which is a major factor in the international gold market. Possession of gold affects national wealth and economy by influencing prices and offering diversification.

The table below summarizes official organizations and central banks with sizeable gold reserves:

| Organization | Country | Gold Reserves (in metric tons) |

|---|---|---|

| Federal Reserve System | United States | 8,133.5 |

| European Central Bank | Eurozone countries | 10,524.1 |

| International Monetary Fund (IMF) | N/A – Global Institution | 2,814 |

| Reserve Bank of India | India | 626.2 |

| People’s Bank of China | China | 1,948.3 |

The IMF is a global body that keeps the monetary system stable. Their gold reserves back their currencies and give assurance to other nations about their policies.

For transparency and accountability, it is wise for official organizations and central banks to publish updates on their gold holdings. This will build trust among investors and help stabilize the global gold market. Furthermore, if these institutions cooperate in managing gold reserves, coordination during times of economic difficulties or market fluctuations will be improved, allowing for more effective use of gold.

Impact on National Wealth and Economy

Gold ownership has a big effect on national wealth and the economy. Countries with a lot of gold, such as official groups and central banks, have an important part in forming their financial standing. This gold can help the steadiness and worth of a country’s currency. It can also help the nation stop economic problems and back its money system.

People and companies having gold also affects national wealth and the economy. People may use their gold as an investment or store of worth, which affects the demand and prices of gold. Businesses and organizations may hold gold to protect against currency changes or diversify their investments.

The actions of individual owners can impact the gold market worldwide and influence national wealth and economies. Buying and selling gold by private owners can cause changes in currencies, inflation rates, and economic conditions.

Venezuela is an example of how private gold ownership affects national wealth. With oil and gold reserves, Venezuela had economic issues due to bad management and corruption. People tried to safeguard their wealth by buying physical assets like gold. This caused a lack of cash in the country, making hyperinflation worse. Transferring private wealth into physical assets like gold weakened Venezuela’s economy as it faced political and social troubles.

Impact of Private Gold Ownership

Photo Credits: Ecopolitology.Org by Bradley Hall

The impact of private gold ownership is significant, and it affects various aspects of the gold market. We’ll explore how private ownership influences gold market prices and its role in investment and diversification. Understanding these dynamics is crucial for anyone interested in the world of gold ownership, as it sheds light on the factors that drive market trends and the benefits of incorporating gold into one’s investment portfolio.

Influence on Gold Market Prices

Gold ownership and trading has a big effect on its prices. People, companies, and organisations all add to the demand and supply of gold.

Private people and families own a lot of gold. They buy it for many reasons, such as to store value, protect against inflation, and preserve wealth. They invest in physical gold, like coins or bars, and in investment products like ETFs. This affects gold market prices.

Private corporations and organisations also have lots of gold. They use it in jewelry and other industries. Their buying and selling impacts both physical gold demand and its price.

Countries with large gold reserves also influence gold market prices. Central banks hold huge amounts of gold as part of their reserves. When they buy or sell, it affects global demand.

Gold’s role in investment and diversification strategies increases its influence on gold market prices. People use it during economic uncertainty or geopolitical tensions. More investors putting their portfolios in gold increases demand, and so does its price.

Role in Investment and Diversification

Investment in gold is crucial for portfolio diversification. Historically, gold has been seen as a safe-haven asset; providing stability and protection against market turbulence. Private ownership of gold safeguards against inflation, currency fluctuations and geopolitical risks.

Individuals and families recognize the worth of gold as an investment. Keeping physical gold or investing in gold-related ETFs or mutual funds can reduce overall risk. Private investors contribute to the price and liquidity of the gold market.

Businesses and organizations also appreciate gold as an investment tool. They keep gold reserves or strategic asset allocation. Gold helps balance risks, especially when economies are unstable.

Private ownership of gold has wider implications. Countries with significant gold reserves held by private people or businesses can benefit from increased wealth and potential economic stability. These reserves can back domestic currencies, support financial markets or fund government projects.

In conclusion, the importance of private gold ownership for investment and diversification is clear. It gives individuals, families, corporations and organizations a way to protect wealth, mitigate risks and achieve financial goals. As the global economy evolves, the demand for private gold ownership is expected to stay strong, as investors look for wealth preservation options beyond traditional asset classes. Repatriation of gold reserves: Bringing back the shiny bling just got a whole lot trickier.

Repatriation of Gold Reserves

Photo Credits: Ecopolitology.Org by Adam Nguyen

Amidst discussions on gold ownership, the repatriation of gold reserves takes the center stage. Delving into the reasons behind this movement, as well as the associated challenges and considerations, uncovers a compelling narrative of national economic strategies and geopolitical dynamics.

Reasons for Repatriation

Repatriation of gold reserves is when a country brings back its gold stored in foreign countries. There are several reasons why this may be done.

- One is to ensure security and control, so that the gold can be stored safely and there’s less risk of it being lost or stolen. This can create a feeling of stability and trust in the economy.

- Another reason is in case of geopolitical tensions or conflicts. A country may bring back their gold as a protective measure, so they have direct possession of it for use in a crisis.

- It can also be for national pride and to show heritage and wealth. This is a symbol of independence, sovereignty and economic strength.

However, repatriation is not without challenges. It involves transporting large amounts of gold securely, which takes careful coordination between countries, central banks and other parties. It can also influence the global gold market if a lot is repatriated at once, potentially affecting prices and supply-demand dynamics.

In conclusion, repatriation of gold reserves can be done for multiple motives; to secure wealth, assert control, reduce risks and show national pride.

Challenges and Considerations

Challenges and considerations exist with private gold ownership. These include lack of transparency and reporting, as well as its effect on the global market. To comprehend these intricacies, it is essential to address issues such as transparency, market impact, knowledge gaps, regulatory frameworks, and international cooperation.

This can assist in making informed decisions which will contribute to the stability and sustainability of private gold ownership. Do not neglect understanding the complexities of private gold ownership in today’s global market atmosphere.

The Biggest Private Gold Owners

Photo Credits: Ecopolitology.Org by Justin Harris

The largest holders of gold, both private individuals and corporations, dominate the world of precious metals. In this section, we’ll unveil the biggest private gold owners and delve into the fascinating realm of their vast collections. From influential investors to powerful corporations, we’ll explore their significant role in shaping the global gold market. Prepare to discover the immense wealth and influence held by these prominent entities in the world of gold ownership.

Private Individuals and Investors

Private individuals and investors have always been essential to the ownership and collection of gold. High-net-worth individuals, families, and collectors are aware of gold’s worth. They get and keep their gold for many reasons – wealth preservation, protecting against inflation or economic uncertainties, and holding its value.

Gold is seen as a secure investment by private individuals. They know its background and that it retains its worth over time. Plus, they think about the diversification gold gives. By including it in their portfolios, they aim to reduce risk and get better results.

Individuals can own physical gold like bars and coins or invest in gold-backed financial instruments like ETFs or mining company shares. It depends on their desires, storage needs, liquidity needs, and strategies.

Recently, private individuals have been more likely to take their gold reserves from foreign vaults back to their home countries. This follows fears of geopolitical risks, economic stability issues, and wanting more control of their assets.

Famous investors like Warren Buffett and George Soros have owned huge amounts of gold. They’ve given their opinions on gold as an investment and have given large parts of their portfolios to this metal.

In conclusion, private individuals and investors are still extremely significant in the gold market. Their activities with gold directly affect global prices and influence the gold market.

Private Corporations and Entities

Private corporations and entities possess large amounts of gold. These companies and organizations have a significant influence on global gold prices.

They acquire gold to invest or diversify. It could be directly from mines or through financial instruments. Furthermore, they use gold for industrial purposes, like jewelry making, electronics, and medical applications. Additionally, they hold gold as a hedge against inflation or other economic uncertainties.

Moreover, through their trading activities, these entities can affect the demand and supply of the gold market.

It’s noteworthy that private corporations and entities have various reasons for holding gold. While some use it as an investment, others do so for practical reasons.

Moreover, these entities are some of the biggest owners of physical gold in the world. Their substantial holdings are part of the large amount of privately-owned gold globally.

Challenges in Determining Gold Ownership

Photo Credits: Ecopolitology.Org by Jesse Jones

Challenges arise when determining gold ownership, notably in terms of transparency, reporting, and the impact on the global market.

Lack of Transparency and Reporting

The gold ownership market is shrouded in opacity, leading to immense worry amongst investors and regulators. It’s hard to accurately trace the true owners of this precious asset, meaning misinformation and potential market manipulation can occur.

This lack of transparency brings forth a variety of issues, such as:

- Inability to determine who owns what: Transactions typically take place privately, making it hard for regulators to track the movement of gold and guarantee accurate reporting.

- Unregulated markets: These underground markets make it difficult to gauge the true supply and demand, resulting in market distortions.

- Inaccurate reporting: Investors struggle to obtain reliable data on the factors that drive gold prices.

- Vulnerability to fraudulent practices: The market’s opacity makes it vulnerable to counterfeit bars or false claims of ownership.

- Possibility of market manipulation: Those with large amounts of gold can control or manipulate information about their holdings, influencing prices and creating artificial market conditions.

To ensure fairness and transparency, it is necessary to introduce initiatives which improve tracking mechanisms, create stricter reporting regulations, and increase regulatory oversight. It is vital that investors do their research when investing in gold, selecting reputable dealers or platforms that prioritize transparency and comply with regulatory guidelines. This can help reduce the risks associated with the lack of transparency and make for a more secure investment experience. Shine on with some gold ownership in your portfolio!

Impact on Global Gold Market

Private individuals and families play a big role in the global gold market. They often invest in gold as a safe haven asset. Their buying and selling decisions can have a large effect on gold prices, especially when there’s high demand. Plus, they diversify their investments by including gold.

Corporations and organizations also impact the global gold market. They may hold large amounts of gold for their strategies or to hedge. Their actions, like buying or selling substantial amounts of gold, can change market liquidity and sentiment.

Central banks also hold hefty amounts of gold reserves. They help maintain economic stability by controlling these reserves. Decisions they make regarding gold holdings can have far-reaching effects on the global gold market.

Private ownership of gold has impacts beyond prices and investments. It affects geopolitical relations between countries, like repatriation efforts. Some countries repatriate their gold reserves due to political, economic, or security concerns. This disturbs the balance of power in the global gold market.

Investing in gold is like holding a tiny bit of the sun. But the sun doesn’t sparkle or make you feel richer.

Future of Gold Ownership

Photo Credits: Ecopolitology.Org by Stephen Taylor

As the gold market continues to evolve, it is crucial to explore the future of gold ownership. In this section, we will examine the impact of central bank policies on gold reserves, as well as the changing market dynamics and investor sentiment. By understanding these factors, we can gain insight into who may hold the most gold privately in the years to come.

Central Bank Policies and Gold Reserves

Central banks have an important role when it comes to influencing gold reserves. What they do – like buying or selling – can have a big effect on the global gold market.

Their policies depend on economic, political, and geopolitical factors. They look to balance decisions in order to ensure stability and security in both domestic and international financial markets.

Who Owns the Most Gold Privately?

The actions of central banks can influence how people view gold as an investment asset and the market prices. As they are big players, it’s vital for those interested in gold to follow central bank updates or announcements. This can help individuals make better decisions about their portfolios and not miss out on advantages from central bank policies.

The gold market is always changing and stirring strong emotions.

Changing Market Dynamics and Investor Sentiment

The market is ever-changing and investor attitudes are key to the future of gold possession. These elements influence supply and demand, which affects gold’s cost and worth. Investor sentiment, or the overall view and trust in the gold market, causes buying and selling tendencies to vary, further affecting market mechanics.

Many factors cause changes in market dynamics, such as economic conditions, geopolitical events, policy alterations by central banks, and shifts in investor preferences. For example, when economic conditions are uncertain or unstable, investors tend to seek safety in assets like gold, resulting in increased demand and potentially higher prices. On the flip side, when the economy is thriving or when other investment choices look attractive, investor sentiment towards gold may weaken.

Investor sentiment has a big part to play in whether people invest or divest from gold. It is affected by various factors like market info, media coverage, economic indicators, and expert opinions. Positive feelings can lead to more investments in gold, either to maintain wealth or diversify portfolios. Whereas negative sentiment can lessen enthusiasm for gold as an investment.

It is essential for market participants to observe the changing market dynamics and investor sentiment, as they have a huge influence on overall gold ownership trends. By understanding these dynamics and sentiments, individuals and organizations can make wise decisions on their gold holdings and investment strategies. Adapting to these changes is important for managing the intricate world of private gold ownership.

Conclusion

Photo Credits: Ecopolitology.Org by Lawrence Davis

Both influential individuals and central banks have immense stakes in the gold market, highlighting its lasting value. Global supplies of gold are highly sought-after and valuable. Private owners of gold face a complex task, with limited public info on exact holdings of individuals. Famous billionaires like John Paulson and Eric Sprott have reportedly invested in gold. The true extent of their holdings is confidential. Central banks too, such as the US, Germany, and Italy, have substantial gold reserves for monetary and financial stability. Private ownership of gold is a nuanced subject, with details shrouded in secrecy. It is hard to accurately determine the extent of gold held by private owners. Despite this, it is clear that influential individuals and central banks have substantial stakes in the gold market, highlighting its enduring allure.

Some Facts About Who Owns the Most Gold Privately:

- ✅ John Paulson, Ray Dalio, Stanley Druckenmiller, Eric Sprott, and the royal family of Saudi Arabia are among the individuals and families that own the most gold privately. (Source: Team Research)

- ✅ Indian households, primarily through gold jewelry, also hold significant gold reserves. (Source: Team Research)

- ✅ The World Gold Council estimates that there are 208,874 metric tons of gold mined worldwide, but it’s difficult to determine how much gold remains. (Source: Team Research)

- ✅ Private gold ownership allows investors to avoid extra costs associated with government-backed bullion, but government bullion provides security and stability. (Source: Team Research)

- ✅ The US Federal Reserve has the highest gold reserves in the world, followed by Germany and Italy. Other countries with significant gold reserves include China, France, and Russia. (Source: Team Research)

FAQs about Who Owns The Most Gold Privately?

1. Who are some notable private owners of gold?

Answer: Some notable private owners of gold include John Paulson, Ray Dalio, Stanley Druckenmiller, Eric Sprott, the royal family of Saudi Arabia, and Indian households.

2. How much gold do Indian households hold?

Answer: Indian households collectively own the largest amount of gold in the world, with roughly 24,000 metric tons, mostly in the form of jewelry used for festivals like Diwali and weddings.

3. Do independent estimates of global gold reserves differ from official figures?

Answer: Yes, independent researchers’ figures on global gold reserves have a 20% disparity from the World Gold Council’s findings, indicating discrepancies in the reported data.

4. Which countries have the highest official gold reserves?

Answer: The countries with the highest official gold reserves are the US Federal Reserve, Germany, Italy, France, Russia, and China.

5. What are the reasons for undisclosed gold reserves?

Answer: Undisclosed gold reserves can exist due to illegal gold mining, political advantage, currency manipulation, conflicts, financial upheavals, or countries downplaying their reserves for trade purposes.

6. How can individuals invest in gold?

Answer: Individuals can invest in gold through various means such as purchasing physical gold bullion, investing in gold IRAs offered by companies like Augusta Precious Metals or American Hartford Gold, or participating in the gold market through investment vehicles.

.jpg)